College Planning

An Expert Guide Can Lead You in a Wealth of Directions

How Our College Planning Process Works

We start by clarifying your current financial situation and future goals, then determine a ‘best course of action’. Ultimately the goal is to get your student the best education possible without jeopardizing your retirement dreams.

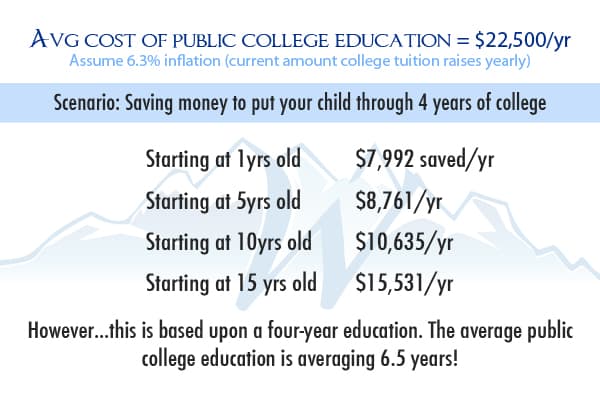

College is a major investment in most family’s lives. It’s critical to understand the impact of paying for your child’s education without properly determining the impact on your other financial priorities. If you don’t carefully evaluate this you might end up putting your child in the position of having to care for you during your unfunded retirement, while raising their own children.

As in everything, the earlier you plan the better. The financing of college education can be one of the largest wealth transfers during a parent’s lifetime and for the student the financial impact can easily exceed $1,000,000.00.

Without all the information and options a family could ultimately end up paying more for their child’s education than necessary. Our job is to make sure you understand all the options and help come to a decision as to what is right for your family. This can be an overwhelming process with a variety of questions racing through your mind.

My goal is to help you answer those questions and give you confidence in sending your child off to college. Come in for a complimentary conversation; let’s see how I can help you.

By meeting with us we can provide you with

- Peace of mind and clarity in the decision making process.

- Evaluation of ‘real’ costs of college and the common myths of calculating these costs.

- A better education for less out-of-pocket expense.

- Expanded college choices for your child.

About Our One-Hour Session

By sitting down with us, you can potentially save thousands of dollars on a college education. If you have several children heading off to college then this number can grow considerably! During our initial consultation we will help you understand what opportunities you have available to control the cost of college.

We begin coaching you through the process of funding an education without jeopardizing your retirement, providing you better peace of mind. This process is full of many difficult questions and potentially expensive pitfalls. Whether you have a newborn or your child is already in college, the planning process is critical at any point. To help reduce the financial impact of paying for college, it is critical that you understand the funding process and the unique planning opportunities available.

It's never too late to start planning

Most everyone is familiar with the necessity of a college education and the expense involved, but far too many fail to understand the business aspect. Although funding for college was originally intended for those who need it most, it actually goes to those who know the most about the process

The more you know, the more you get!

Likewise, the less you know, the less you are likely to receive. Since the colleges themselves are the single, largest source of funding, especially the free money; it would stand to reason that dealing with uninformed consumers is ideal. This explains statements like: “you can do it yourself, for free” and “you don’t need to hire anyone to help you.”

We believe it’s critical that you understand all the funding vehicles that can help you pay for college. Once you understand the different ways to pay for college you can ultimately save yourself thousands. Working with me you will learn all the options available to you and we will determine the best most cost effective way to pay for your child’s education.

Many are mislead into thinking that if the forms are free, the process must be easy. Actually, it is exactly opposite. There are so many variables involved and details to consider, most families simply don’t have the time to do the necessary research, devise a plan, and stay on track throughout the entire process.

Important note: The free forms are not the focus, knowing how to complete them to your best advantage is.

The answers given on the FAFSA

..are just like those given on tax forms; these answers determine how much you pay.

Like the FAFSA, income tax forms are also “free.” However, nobody seems to be overly concerned about people hiring a professional to assist with tax returns.

If tax forms, codes and laws are all available for free, why do people hire accountants? Simply put, they don’t want to pay more than their fair share of tax.

IF YOU DON’T COMPLETE THE FAFSA PROPERLY…THEN YOU MIGHT PAY MUCH MORE!

Make sure to visit the CORRECT FAFSA WEBSITE, which should look like this. There are other sites out there that look like you’re on the actual FAFSA site, however when you’re done they will charge you a fee.